5 Security Trends Every Banking CISO Should Track in 2025

Discover how complexity, compliance, and the email attack surface are reshaping banking risk.

August 7, 2025

Cyber risk has long dominated boardroom agendas in banking—but 2025 marks a turning point.

With new regulations like the EU’s Digital Operational Resilience Act (DORA) now in force, banks face just 24 hours to notify supervisors after a material cyber incident. Meanwhile, attackers have shifted from broad phishing campaigns to highly targeted business email compromise (BEC). And for many CISOs, the biggest threat isn’t a missing control—it’s the growing complexity of tools already in place.

The five trends below explain why the conversation is shifting—from buying more point solutions to simplifying what’s already there.

1. Complexity is the Compounding Risk You’re Not Seeing in the Budget

For the past decade, the reflex answer to every new threat was to add another control. The unintended result is a labyrinth of consoles, licence renewals, and duplicate alert streams. Complexity now erodes value in two ways. First, it consumes scarce operating funds through integration and maintenance. Second, it extends dwell time because analysts must reconcile conflicting alerts before acting.

CISO Recommendation: Begin measuring “cost of complexity” as a key performance indicator. Track analyst hours lost to console switching and the spending absorbed by integrations that simply keep tools speaking to each other. Boards respond quickly when hidden costs become visible and quantifiable.

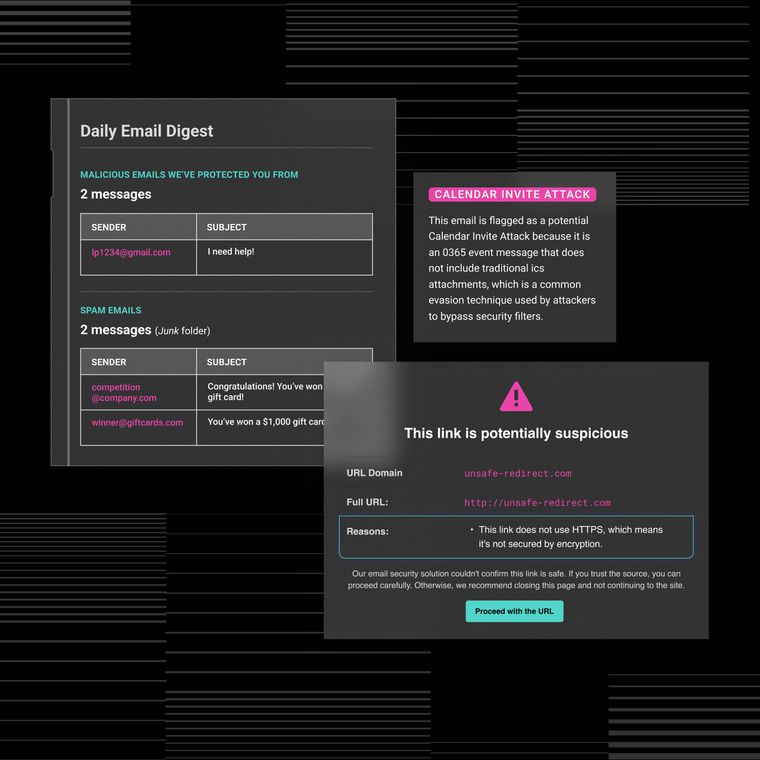

2. Email Remains Attackers’ Most Profitable Path

Endpoint, network, and cloud controls have improved markedly. Adversaries have responded by investing in low-volume, high-yield campaigns that exploit human trust. Vendor email compromise (VEC), for example, leverages genuine correspondence lines to slip in a fraudulent invoice that looks perfectly routine. Traditional gateways, which focus on known bad senders or malware payloads, struggle to flag messages that contain neither.

CISO Recommendation: Treat email as a living ecosystem that needs behaviour-based analytics on par with your fraud detection platforms. Modern controls evaluate tone, timing, and relational context, not just headers and attachments.

3. Platform Thinking Beats Point-Product Stacking

Banks that have rationalised controls onto an integrated security platform report materially faster detection and containment. The improvement comes from fewer hand-offs, shared data models, and consistent enrichment at ingest.

It’s not just operational gain—consolidation frees up budget from redundant tools and helps close audit cycles more efficiently.

CISO Recommendation: Pilot consolidation where the upside is high and the disruption is low. Email security is the ideal start. It is measurable, highly visible, and frequently duplicated across legacy gateways, cloud APIs, and mailbox rules.

4. Breach Economics Are Now Tied To Capital Costs

Even as detection speeds improve, incident costs continue to rise as settlement fees, restitution, and reputational damage show no sign of falling.

Credit-rating agencies have begun to incorporate cyber resilience indicators into operational risk scores. A series of costly breaches can raise wholesale funding costs just when banks need liquidity for digital expansion.

CISO Recommendation: Frame cybersecurity investment as protection against interest rate pressure. Faster recovery and reduced breach likelihood directly support lower funding costs—a value story CFOs grasp instantly.

5. Regulators Measure Response Time in Hours, Not Weeks

Under DORA, banks have just 24 hours to report an incident. In some cases, supervisors expect an initial alert in as little as four hours. Manually stitching together logs from legacy gateways, archives, and cloud platforms simply doesn’t meet the clock.

CISO Recommendation: Conduct a timed simulation that starts with an alert and ends with a completed regulator draft. Anything that cannot be completed within one business day needs automation or removal.

Bringing it Together: Why Email Consolidation is the Quickest Win

Tool sprawl, email-delivered fraud, extended dwell time, escalating breach costs, and tighter reporting windows share a single root cause: fragmented controls.

Email lays bare the issue because it touches every employee and every outside counterparty. Unifying email security on a behaviour-based platform delivers immediate benefits:

Noise Reduction: Normalised telemetry and automated enrichment collapse duplicate alerts, giving analysts space to think.

Shorter Dwell Time: Relationship-aware analytics surface business email compromise and vendor fraud before the finance team sees a change-of-account request.

Faster Audits: Consistent evidence packs satisfy DORA, GDPR, and PCI without marathon log collection exercises.

Once the board sees measurable risk reduction and positive return on investment inside one reporting cycle, momentum builds for broader platform adoption.

Executive Checklist for Your Next Board Pack

Objective | Recommended Action |

|---|---|

Quantify Complexity | List every email-related control and its annual run cost, then highlight overlaps. |

Benchmark Dwell Time | Compare present detection and containment intervals with peers that have already consolidated. |

Test Regulatory Readiness | Time a live drill from first alert to draft incident notice; aim for an internal eight-hour goal to leave a margin. |

Model Breach Impact | Use sector averages, then adjust for your transaction volume and data sensitivity. |

Build the Value Story | Link savings from retired licences and faster audits to strategic growth programmes. |

Complexity drains value, attackers target the inbox, and regulators now measure response times in hours, not weeks. Simplifying email defenses with behavior-based AI gives you measurable risk reduction, faster audits, and a budget you can redeploy to growth.

Ready to take control and start banking on secure email? Visit our Banking Security Hub

Related Posts

Get the Latest Email Security Insights

Subscribe to our newsletter to receive updates on the latest attacks and new trends in the email threat landscape.