What's the Role of Cyber Security Insurance in Risk Management Strategies?

See how cyber insurance complements your security strategy—and what it really covers.

Abnormal AI

Cybersecurity insurance serves as a critical financial safeguard when cyber incidents bypass technical defenses. Email remains the most common attack vector, particularly through business email compromise and funds-transfer fraud. The FBI IC3 reported financial damages amounting to $16.6 billion, with over 17% directly linked to business email compromise (BEC). In 2024, BEC incidents resulted in losses totaling $2.77 billion from 21,442 reported cases.

Therefore, an effective risk management strategy requires not only strong technical controls but also clearly defined post-incident procedures. Cyber insurance helps fill this gap by covering breach response, business interruption, and legal liabilities, while encouraging stronger preventive measures. This guide outlines how to integrate cybersecurity insurance into your broader risk management framework to enhance protection and control costs.

Understanding Cyber Security Insurance

Cybersecurity insurance offsets the financial fallout of cyber incidents through two distinct layers. These are first-party and third-party coverage. However, you only unlock its value when you know exactly what's included, what's excluded, and how tightening underwriting requirements shape the policy.

First-Party Vs. Third-Party Coverage

First-party coverage protects your own balance sheet. When ransomware locks servers or a breach corrupts data, the policy reimburses you for system restoration, business interruption, extortion payments, and breach notification.

Third-party coverage, often called cyber liability, steps in when customers, partners, or regulators hold you responsible for their losses. It pays defense costs, settlements, and regulatory penalties tied to privacy or security failures.

This split matters because many carriers set different limits, deductibles, and sublimits for each side. Clear alignment between your risk appetite and these limits prevents surprises when a claim hits the books. For a concise overview of these distinctions, you can always review your industry's key coverage areas.

What a Modern Policy Typically Covers

A well-structured policy should address the complete incident lifecycle through several key areas. These include:

Immediate Response: Forensic investigation costs to identify attack vectors, legal counsel for regulatory compliance, and crisis communications to maintain customer trust during incidents.

Business Continuity: Lost revenue during system downtime, extra expenses for alternative operations, and contingent coverage if critical cloud providers experience outages that impact our services.

Customer Protection: Breach notification costs, credit monitoring services for affected individuals, and specialized coverage for business email compromise incidents where sublimits are often restrictive.

Liability Defense: Legal defense costs for customer claims, settlement payments, regulatory fines under GDPR or CCPA, and professional liability related to our security services.

Watch the exclusions and evolving requirements

Exclusions are where otherwise solid claims break down. Most policies carve out acts of war or nation-state operations, leaving you exposed during large-scale campaigns. Losses linked to unpatched systems, dishonest insiders (here are some insider threat examples), or outages caused by hardware failure are frequently omitted as well.

Also, remember that ransomware payments may be halved or denied unless you maintain immutable backups and notify the insurer before paying.

Read the fine print on social engineering clauses in particular and remember on which of the following techniques these attacks rely on. This is critical because some policies treat funds-transfer fraud as a separate, lower-limit event.

Overall, staying ahead of these shifting requirements ensures your coverage responds when you need it, rather than becoming just another sunk cost.

Integrating Cyber Security Insurance into Risk Management

Cyber insurance complements your technical controls by converting the residual risk you cannot fully mitigate into a predictable premium rather than an open-ended loss. When you map this transfer against your defined risk appetite, you can decide which threats to absorb, which to remediate, and which to insure.

Align Insurance with Enterprise Risk Management

Fold cyber insurance into the same enterprise risk management matrix you already use for operational, financial, and regulatory risks. The Office of the Superintendent of Financial Institutions' guidance on technology and cyber risk management recommends a single governance structure with clear lines of accountability, from board oversight to the incident response lead, so that security controls, insurance requirements, and reporting obligations stay synchronized.

Translate Technical Risk to Financial Impact

Estimate the monetary impact of business-email compromise, ransomware downtime, or privacy litigation, then compare those figures with proposed coverage limits, deductibles, and sublimits. This exercise keeps the policy aligned with both your tolerance for loss and the realities of your threat model.

Assign responsibilities early: the CISO owns control verification, risk managers handle policy negotiations, and finance tracks premium efficiency. Document these roles in your incident response plan to avoid coverage disputes during a breach.

That being said, the next step is to understand how to evaluate cybersecurity insurance policies.

Evaluating Cybersecurity Insurance Policies

A thorough policy evaluation ensures your cyber insurance provides meaningful protection when a breach threatens your organization’s financial health. Begin with the core coverage details, total policy limits, any specific caps for ransomware-related incidents, and the retention amount your organization must cover before the insurer contributes.

Beyond coverage amounts, assess the insurer’s incident response ecosystem. Strong policies offer immediate access to breach response support, including legal advisors, forensic investigators, and public relations professionals. These vendor teams are often pre-approved and integrated into the insurer’s panel, so confirm that their services align with your internal response plans to avoid delays during a crisis.

Underwriting is now a proxy for a cybersecurity audit. Be prepared to complete detailed security questionnaires, undergo external risk assessments, and provide evidence of controls like multi-factor authentication, endpoint detection, and secure backups. If insurers find significant gaps, they may raise premiums or deny coverage, though they rarely disclose the full criteria for policy approval.

Before committing, ask direct questions to clarify policy scope and avoid gaps in coverage:

What triggers specific sublimits, and how quickly can they be depleted?

Which expenses count toward the retention, and which are covered immediately?

How are business interruption losses measured and validated?

Are we required to use vendors from your panel, or can we use our own incident-response team?

What is your denial rate for claims based on missing controls?

These answers can reveal potential weaknesses in coverage. Remember, a comprehensive evaluation today helps prevent costly surprises after a breach.

Cybersecurity Insurance and Incident Response

Effective coordination between your incident response strategy and cyber insurance policy can be the difference between a fully paid claim and a denied one. That said, here are the key components of insurance-aligned incident response:

Timely Notification is Critical: As soon as suspicious activity is detected, the incident response team must act in accordance with the policy's notification requirements. Many insurers require notification within a narrow time window. Delays can lead to claim denial, so speed is essential to protect both your systems and your insurance coverage.

Insurer-Coordinated Response Accelerates Recovery: Once notified, insurers often deploy pre-approved response teams that include forensic analysts, legal counsel, and public relations experts. These resources help manage the breach quickly and efficiently, eliminating the need to vet vendors in the middle of a crisis.

Documented Response Plans Build Resilience: Maintaining a tested incident response plan enhances both preparedness and your insurance position. For example, when an organization detects a phishing attack within minutes, engages its insurer’s response team, and contains the threat before financial damage, it is a great example of building resilience. Because the plan was clearly documented and executed, the incident could be resolved quickly with minimal loss.

Remember, aligning your incident response plan with your cyber insurance policy ensures faster recovery, supports successful claims, and reduces overall impact. A proactive, documented approach builds confidence with insurers and helps protect your business when it matters most.

Reducing Insurance Costs with Proactive Security Measures

Cyber insurance premiums decrease when you can demonstrate strong, verifiable security controls that minimize risk for underwriters. Insurers now evaluate your cybersecurity posture with the same rigor as financial health, and many claims are denied due to missing or undocumented safeguards.

You can shift this outcome by showing continuous, measurable protection. Most insurers maintain consistent expectations for core security controls, such as multi-factor authentication, endpoint monitoring, tested data backups, and dedicated email protection to prevent business email compromise.

Enhancing these baseline defenses with AI-driven behavioral analytics signals a more advanced approach to risk management. To strengthen your case, document each control clearly, including responsible owners, testing procedures, and audit-ready records. When it's time to renew your policy, this evidence positions you to negotiate from a place of strength, improving your chances of receiving more favorable coverage and cost terms.

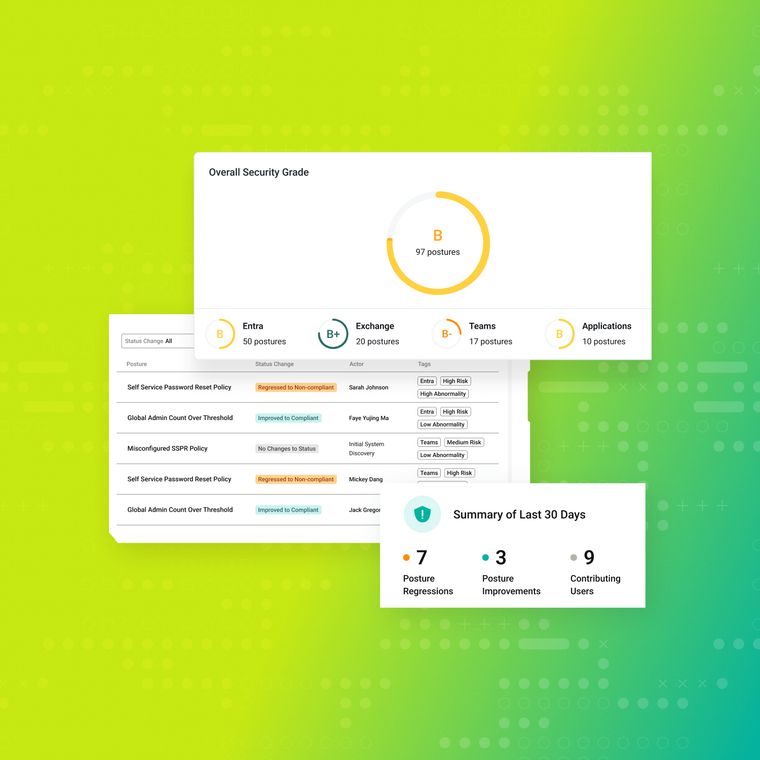

How Abnormal AI Supports Cyber Security Insurance Goals

Abnormal strengthens cybersecurity insurance readiness by using behavioral AI to detect and block advanced email threats, which is the most common entry point for attacks. By analyzing normal and abnormal communication patterns, Abnormal effectively stops phishing, business email compromise (BEC), and account takeovers, incidents often excluded from insurance coverage due to their high risk.

The platform delivers rapid detection and full visibility into threats, meeting insurer expectations for swift incident response. Its detailed reporting also documents security controls clearly, helping organizations demonstrate strong risk management practices, often leading to better insurance terms.

By integrating Abnormal into your cybersecurity strategy, you not only reduce risk exposure but also align more closely with insurer requirements. Request a demo to see how Abnormal’s AI-driven solutions can support your risk management and insurance goals.

Related Posts

August 7, 2025

August 6, 2025

August 5, 2025

Get the Latest Email Security Insights

Subscribe to our newsletter to receive updates on the latest attacks and new trends in the email threat landscape.