Sophisticated Pretexting Scams Targeting C-Suite Executives

Understand how pretexting scams target executives and how to spot early signs of these rising pretexting scams.

November 13, 2025

When someone in Waltham transferred nearly $12,000 through a cryptocurrency ATM in December 2024, believing Apple's security team needed immediate payment, he became the latest target of pretexting: the art of creating fabricated scenarios to manipulate victims into surrendering money or sensitive information.

Unlike phishing's spray-and-pray approach, pretexting operations like the one in Waltham resemble intelligence gathering. Attackers spend weeks building psychological profiles, learning communication patterns, identifying trusted relationships, and waiting for vulnerable moments to exploit.

They strike during quarterly closings or executive transitions when vigilance naturally weakens. Their weapons aren't malware or exploits. Instead, they target urgency, authority, and meticulously crafted trust that makes even seasoned leaders question their instincts. That said, here are the most sophisticated pretexting scams targeting C-Suite executives.

1. Fake Vendor Payment Requests

Criminals monitor supplier relationships in various modes, then create near-perfect domain spoofs to redirect legitimate payments. A single character difference in an email address can drain millions from corporate accounts. These attacks succeed because they hijack existing trust. For instance, when a familiar vendor requests routine banking updates during quarter-end rushes, the accounts payable rarely questions the change.

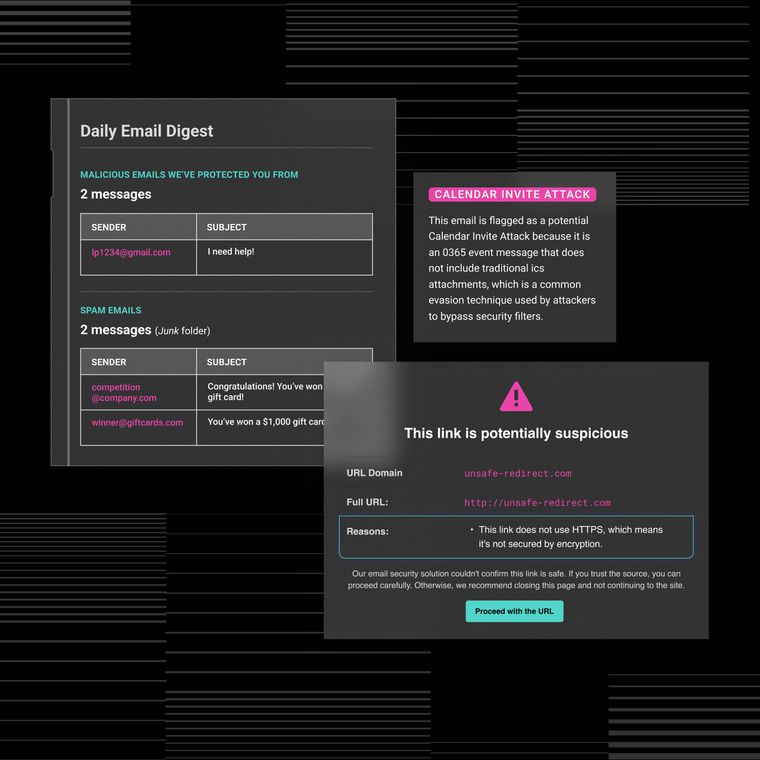

Behavioral AI establishes vendor fingerprints across communication patterns, banking details, and request timing, instantly flagging deviations such as modified routing numbers or unusual urgency that signal fraud attempts before funds are transferred to criminal accounts.

2. Executive-to-Finance Urgency Emails

Attackers research organizational hierarchies to craft convincing C-suite impersonations that pressure finance teams into immediate wire transfers. These social engineering attacks exploit psychological manipulation: when the "CFO" marks something urgent and confidential on a Friday afternoon, subordinates comply without verification. The stakes escalate quickly from routine payments to acquisition funds worth millions.

Advanced anomaly detection analyzes metadata invisible to traditional filters, including geolocation shifts, device fingerprints, and subtle tone variations that deviate from executive baselines, blocking suspicious requests before catastrophic losses occur.

3. Board-Level Impersonations

Sophisticated cybercriminals pose as directors to steal nonpublic financial data from investor relations teams who rarely challenge board authority. One leaked earnings report can trigger SEC investigations and destroy market capitalization overnight. These schemes exploit deference: employees bypass data governance when "the chairman" requests confidential projections for an emergency committee review.

Modern email security builds dynamic relationship graphs tracking authentic board communications through historical patterns, routing paths, and linguistic fingerprints. When spoofed domains or anomalous data requests appear, automated quarantine protects confidentiality while preserving the discretion board members expect.

4. Merger and Acquisitions Intelligence Grabs

During merger negotiations, attackers impersonate legal counsel to steal valuation models and term sheets that competitors use to inflate bidding wars. Leaked due diligence documents can trigger massive breakup fees and destroy years of strategic planning. Criminals exploit transaction urgency, such as when "outside counsel" demands immediate data room access, citing closing deadlines, and deal teams prioritize speed over verification.

Cross-platform behavioral analysis monitors communication patterns across email and collaboration channels, identifying context shifts like late-night document requests from unknown advisors that signal intelligence operations before confidential data leaves the environment.

5. Tax and Payroll Data Requests

Tax season brings sophisticated phishing campaigns where criminals impersonate HR executives requesting bulk W-2s for "audit compliance." These attacks hijack legitimate workflows: when the "CFO" needs employee records by noon, payroll departments comply immediately. Stolen Social Security numbers affect entire workforces simultaneously, triggering class-action lawsuits and federal privacy penalties that devastate both finances and reputation.

Behavioral AI learns normal data-sharing patterns, including file types, distribution lists, and access frequency, quarantining messages when accounts suddenly request comprehensive employee records or target unusual recipients.

6. Gift-Card Fraud at Scale

Fake executives praise employee responsiveness before demanding bulk gift card purchases for "confidential client gifts," insisting on photographed codes sent immediately. This psychological manipulation diverts staff from core projects while they purchase cards, photograph codes, and file reimbursements that further strain finance teams.

Language analysis examines executive communication baselines, flagging linguistic anomalies like sudden praise or purchasing requests that never appear in legitimate correspondence. When high-value gift card demands coincide with these red flags, automated quarantine prevents both financial loss and the morale damage when employees realize they've been manipulated.

7. Travel and Expense (T&E) Scams

Fake travel coordinators email executive assistants with "updated" itineraries, requesting credit card details for nonexistent hotels using perfect corporate signatures. These scams strand executives mid-trip, derailing customer meetings while companies pay cancellation fees on phantom reservations. The time-sensitive nature of travel creates exploitable urgency: finance teams processing last-minute changes skip verification to avoid disrupting board presentations.

Behavioral analytics flag unusual patterns, including suspicious per-diem requests, one-time payees, or destinations outside historical executive travel, alerting teams before fraudulent charges are processed through expense systems.

8. Legal or Regulatory Pretexts

Criminals impersonate SEC investigators or outside counsel, citing imaginary subpoenas that demand immediate document production to "avoid penalties." These fear-based attacks overwhelm decision-making. When faced with shutdown threats, executives surrender earnings data that triggers real regulatory scrutiny and shareholder lawsuits. Premature disclosure sinks share prices overnight while competitors gain strategic intelligence.

AI-powered analysis examines tone, sentiment, and urgency patterns across messages, flagging legalistic threats that deviate from normal correspondence while correlating sender authenticity to block coerced disclosures before market damage occurs.

9. Collaboration Platform Impersonations

Attackers create fake Slack and Teams invitations to harvest executive credentials, gaining persistent access to confidential conversations and project intelligence. Once inside collaboration platforms, criminals monitor discussions for weeks, using insider knowledge to craft increasingly sophisticated follow-up attacks.

This sustained access often remains undetected until significant damage occurs through lateral movement across SaaS applications. Unified security engines provide comprehensive protection across email, chat, and video channels, identifying authentication anomalies and unusual communication patterns that signal platform compromise before attackers establish a persistent presence.

Stop Pretexting Attacks Before They Reach Your Executives

These are some of the sophisticated pretexting scams that bypass traditional security because they exploit human trust rather than technical vulnerabilities. Abnormal transforms this vulnerability into strength through behavioral AI that understands communication patterns, relationship dynamics, and organizational context at machine speed. The platform learns how your executives communicate, which vendors you trust, and what normal workflows look like, then instantly identifies deviations that signal social engineering attempts.

Abnormal provides unified protection across email and collaboration channels, automated response to suspicious messages, real-time vendor risk assessment, and cross-platform behavioral baselines that traditional tools cannot match. This comprehensive approach stops pretexting attacks at every stage: from initial reconnaissance through attempted exploitation.

Ready to protect your executives from costly scams? Get a demo to see how Abnormal can stop pretexting attacks before they drain millions from your organization.

Related Posts

Get the Latest Email Security Insights

Subscribe to our newsletter to receive updates on the latest attacks and new trends in the email threat landscape.