Top Benefits of Artificial Intelligence Fraud Detection for SMBs

Artificial intelligence fraud detection helps SMBs reduce losses, spot anomalies faster, and stay ahead of evolving cyber threats.

August 18, 2025

In March 2024, Canadian retail chain Giant Tiger learned a costly lesson about modern cybersecurity. A breach at one of their third-party vendors exposed 2.8 million customer records, which were all dumped on underground forums for cybercriminals to exploit. What makes this particularly sobering? This wasn't the work of sophisticated nation-state hackers. It was simply inadequate security controls at a communications partner, demonstrating how easily small and medium businesses can become collateral damage in today's interconnected digital landscape.

The targeting isn't random. Verizon's 2025 Data Breach Investigations Report reveals that SMBs are being targeted nearly four times more than large organizations. This is a stark reminder that size doesn't provide anonymity from cybercriminals.

Traditional security tools make this problem worse. For example, old-school systems flag too many legitimate transactions as suspicious, creating headaches for real customers while completely missing the clever new attacks that criminals are actually using. AI fundamentally changes how fraud detection works. This article explores the key benefits of artificial intelligence fraud detection and why it represents a critical advancement for small and medium businesses.

Why Fraud Detection Matters for SMBs

Fraud detection matters for SMBs because it protects revenue and keeps operations running even when teams are small and budgets are tight. Cybercriminals study those realities and strike where defenses are thin, turning limited staff, outdated tools, and manual reviews into easy entry points.

Digital growth widens exposure. For instance, the cloud apps, instant payments, and mobile checkout not only add speed for customers but also create more doors for attackers. Connecting these systems is hard, and rules-based tools often miss new tricks or flag too many good transactions. The result is lost sales, chargebacks, and time your team does not have.

Fraud detection closes gaps by spotting risky behavior early, guiding quick decisions, and reducing false alarms. For SMBs, that means fewer interrupted orders, less money lost to scams, and more focus on customers, not cleanup. Effective fraud protection is a core business function, not a “nice to have,” and it supports business continuity.

How Artificial Intelligence Elevates Fraud Detection

Machine learning models adapt to new attack patterns in real time, while traditional rules-based systems only catch threats that match predetermined signatures.

Traditional fraud detection uses fixed rules that quickly become outdated, but AI takes an entirely different approach. Machine learning systems automatically learn from every transaction, spotting new attack patterns in real-time while dramatically reducing false alarms that frustrate legitimate customers. This adaptive technology transforms security from playing catch-up with criminals to staying ahead of emerging threats.

Here are the key benefits this technology delivers for small and medium businesses:

Improved Accuracy with Less Manual Effort

AI-driven systems can consistently outperform rules-based tools, potentially delivering sharper results with fewer operational challenges for your team. Modern detection platforms may achieve higher accuracy rates compared to legacy systems that often plateau with known attack types and perform worse with new threats. The false positive rate can drop significantly with AI compared to static rules engines.

Every mistaken alert takes time from already lean teams. With intelligent systems, teams may review fewer cases, potentially limit customer disruptions, and process legitimate transactions more efficiently. Lower alert volumes can also help reduce analyst fatigue, while streamlined workflows and behavioral scoring may decrease manual interventions, addressing the burden of operational alert overload.

Smart platforms can triage events quickly, auto-escalate potential anomalies, and learn from each decision. Teams may spend less time labeling transactions and more time refining strategy, training staff, or focusing on revenue-generating initiatives. Additionally, the enhanced accuracy and reduced manual effort can help free limited resources while working to deliver stronger protection.

Real Time Monitoring for Faster Threat Response

Stopping fraud requires split-second decisions, and AI-powered monitoring can deliver that speed by working to halt suspicious activity before transactions complete. Traditional batch-oriented tools review transactions after they settle, potentially allowing real-time payments or instant refunds to process unchecked. Intelligent engines can stream incoming data, score risk, and automatically approve, challenge, or block each event within the time it takes a customer to complete a transaction.

Machine-learning models can evaluate thousands of attributes per transaction, including device fingerprint, velocity, and behavioral patterns, while processing fresh signals. This contextual approach may spot anomalies that static rule sets could miss, such as purchases made from new devices at unusual hours. Also, the real-time analytics processing can help reduce decision windows drastically.

Enhanced accuracy can further amplify speed's impact. Platforms that combine behavioral analysis with adaptive models work to minimize false positives, helping preserve customer experience while protecting revenue. These systems can monitor payment gateways, loyalty programs, and refund requests simultaneously, potentially giving SMBs enterprise-grade visibility without requiring expanded security teams.

Fast, contextual, and automated detection transforms prevention from reactive cleanup into proactive defense that works to protect transactions the moment they occur.

Cost-Effective Protection That Scales

SaaS-based intelligent detection provides enterprise-grade protection without massive upfront investments, then grows seamlessly as your transaction volume increases. Monthly subscriptions replace expensive licenses and lengthy implementations, while vendors manage the platform infrastructure. Deployment typically happens in weeks rather than months, eliminating hardware purchases, system maintenance, and the technical overhead that can stretch lean IT teams.

AI-based threat detection engines work to reduce potential losses, while automation streamlines review processes and can help cut labor costs. Organizations often see positive return on investment as avoided losses and operational savings offset subscription costs, though results vary by implementation and business model.

Since pricing scales with usage, protection can grow alongside your business without requiring major budget renegotiations or additional security staff. Overhead remains more predictable while security capabilities evolve as machine learning models process expanding datasets. This approach transforms fraud prevention from a traditional cost center into a scalable business function that adapts to changing needs without the capital constraints of on-premise solutions.

Building Customer Trust Through Stronger Security

Stronger security fosters customer trust and loyalty by ensuring every transaction is both safe and seamless. Real-time attack prevention safeguards data while minimizing false positives, enabling legitimate purchases to process without friction. Customers enjoy smoother experiences, and support teams reduce time spent resolving avoidable issues. Proactive threat detection also protects brand reputation by stopping attacks before they cause public damage, avoiding costly remediation and negative publicity.

This dual benefit of security and ease becomes a market advantage, attracting new prospects and retaining existing clients. Companies that protect data without creating obstacles position security as a differentiator, driving long-term growth and customer satisfaction.

While these AI capabilities represent a significant leap forward in fraud protection, implementation success depends heavily on choosing the right platform. The most effective solutions combine advanced behavioral analysis with seamless deployment and minimal operational overhead, which is exactly what the resource-constrained SMBs need.

How Abnormal AI Helps SMBs Detect Fraud Smarter

In a world where 28% of socially engineered attacks are opened and only 2.1% are reported, Abnormal delivers the intelligent, always-on security SMBs need to stay safe.

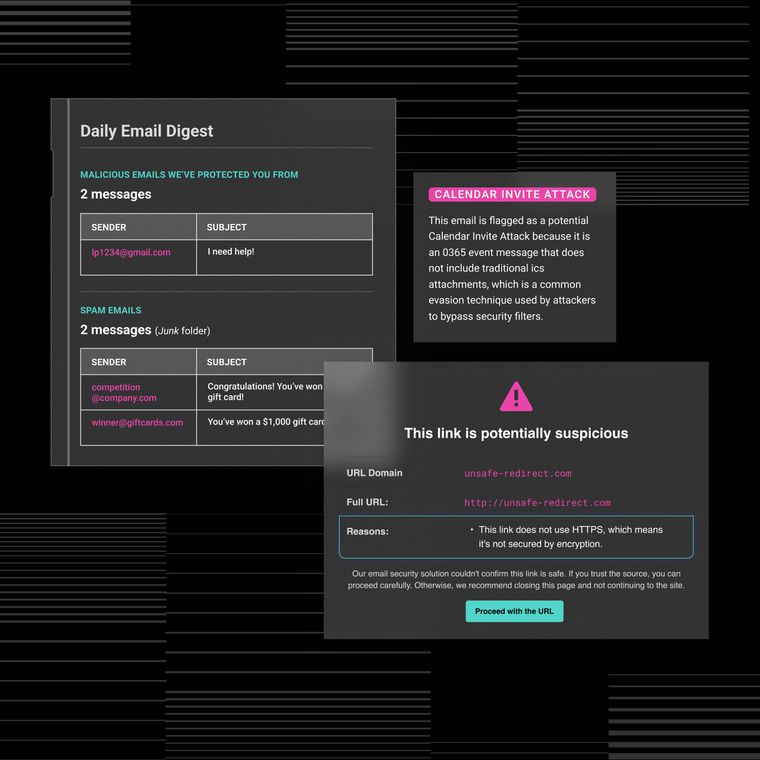

Abnormal’s behavioral AI learns the unique communication patterns of your business, including who talks to whom, tone, and timing. This helps instantly flag anomalies that signal fraud and stops threats from spoofed executives, fake vendor updates, and mid-thread payment diversions.

Deployed via cloud-native API in minutes, Abnormal requires no MX changes and extends protection beyond email to Slack and Teams, creating a unified defense. Automated verdicts and seamless SIEM/SOAR integrations eliminate time-consuming manual reviews, giving lean SMB teams enterprise-grade protection without extra headcount.

As your company grows, Abnormal’s AI adapts, scaling to protect expanding vendor lists, employee bases, and customer channels while maintaining low false positives. With full-channel coverage, faster remediation, and continuous learning, SMBs can prevent costly fraud and sustain customer trust, without slowing business. Book a personalized demo to see how Abnormal can protect your business.

Related Posts

Get the Latest Email Security Insights

Subscribe to our newsletter to receive updates on the latest attacks and new trends in the email threat landscape.