The Key Metrics that Prove Cybersecurity ROI to Your Board

Showcase cybersecurity ROI with clear metrics that demonstrate risk reduction and business value to your board.

August 18, 2025

Cybersecurity leaders face a fundamental challenge, and that is proving their security investments deliver real business value to boards. Success in cybersecurity means stopping attacks before they happen, creating benefits that are hard to see and measure for executives focused on revenue growth.

Boards want clear answers to one persistent question: What value does each security dollar deliver? Budget pressures make this challenge harder as organizations need more security protection while spending less, forcing leaders to justify every purchase with measurable business results.

Today's cybersecurity value goes beyond simply avoiding costs. Strong security protects existing revenue, enables business growth, and maintains competitive advantages. This article talks about the approach that helps cybersecurity leaders choose and present numbers that boards immediately understand and appreciate.

Why Cybersecurity ROI is Hard to Measure but Critical to Communicate

Cybersecurity investments deliver value through risk reduction rather than revenue generation, creating fundamental measurement challenges that distinguish security programs from traditional business functions.

The Invisible Return Paradox

Measuring cybersecurity success is challenging because its value comes from preventing harm rather than generating revenue. While boards easily connect sales efforts to growth or manufacturing investments to efficiency, cybersecurity delivers the protection that often feels invisible. Success means stopping ransomware, avoiding regulatory penalties, and maintaining customer trust, which are critical but hard to measure with traditional financial metrics.

To bridge this gap, CISOs often present cybersecurity as enterprise insurance. Each control reduces the likelihood and impact of major incidents, protecting the business from costly disruptions. Translating prevented incidents into estimated financial impact gives board members a tangible way to understand program value and see how security investments directly support business resilience.

Limitations of Traditional ROI Frameworks

Traditional return on investment models focus on revenue generation, not prevention, which makes them poorly suited for cybersecurity. The real benefits of security, protecting brand reputation, ensuring regulatory compliance, preserving customer trust, and maintaining business continuity, are often invisible until a breach exposes their absence.

Conventional models also fail to account for the fast-changing threat landscape, where risk assumptions quickly become outdated as attackers shift tactics. Modern frameworks address this by converting likelihood and impact into financial risk exposure. Expressing results as reduced annualized loss expectancy gives boards a clear, dollar-based view of how security investments lower risk. This translation replaces technical jargon with financial terms executives understand, making the value of cybersecurity easier to measure and communicate.

Economic Constraints and Communication Imperatives

Cybersecurity budgets face increasing scrutiny, and boards now expect clear evidence that spending reduces risk. General threat awareness or technical jargon no longer suffice, and fear-based arguments undermine credibility. Executives want to see how each dollar invested translates into measurable risk reduction.

Linking reduced exposure to operational performance metrics shows that security programs are improving over time. Framing cybersecurity as disciplined risk management aligned with enterprise goals not only secures funding but also proves that investments deliver real business value.

What Boards Actually Care About When It Comes to Cybersecurity

Communicating cybersecurity effectively at the board level requires aligning security outcomes with the director's priorities. Boards judge success on how well technical safeguards reduce business risk, particularly protecting revenue, operational continuity, regulatory compliance, and brand equity.

Linking Threats to Financial Impact

Directors respond best when cybersecurity risk is expressed in financial terms. Advanced risk modeling allows security leaders to quantify potential losses and show how specific controls reduce exposure. This framing places cybersecurity alongside other enterprise risks, using the same financial language applied in audit and finance discussions.

Highlighting Operational Resilience

Beyond financial impact, boards prioritize continuity of operations. They recognize that not every incident can be prevented, but they support investments that accelerate detection, response, and recovery. Positioning controls and incident response processes as resilience enablers resonates strongly.

Proving Systematic Progress

Boards require evidence of improvement over time. Trend-based metrics such as faster remediation rates or declining attack success, paired with business context, demonstrate program maturity and justify investment.

Framed this way, cybersecurity shifts from a perceived cost center to a disciplined risk management function that protects long-term enterprise value.

Core Metrics that Resonate in the Boardroom

Security executives build credibility with boards when metrics connect directly to financial impact, operational resilience, and strategic objectives rather than technical activity. The metrics that matter most translate security performance into business risk and financial outcomes, shaping budget and investment decisions.

Financial Impact and Risk Quantification

Boards expect cybersecurity discussions to begin with monetary analysis. Annualized loss expectancy models estimate projected losses from major threat vectors, while Return on Security Investment calculations show how individual controls reduce exposure per dollar spent.

Mature programs can extend this approach by converting probability and impact into present-value risk, allowing comparison with other capital investment options. Framing cybersecurity as loss prevention aligns it with enterprise financial priorities.

Operational Effectiveness and Incident Response

Beyond financial clarity, directors want proof that detection and response capabilities are improving. Mean Time to Detect and Mean Time to Respond demonstrate efficiency, while trend analysis confirms continuous learning and automation. Categorizing incidents by business impact, such as service disruption or regulatory exposure, shows whether severe events are declining as early-stage detection improves.

Progress and Improvement Indicators

Boards also require evidence of long-term progress. External security rating improvements provide benchmarks and influence insurance considerations. Meeting service-level objectives for critical vulnerability remediation demonstrates engineering discipline. Third-party risk metrics, including vendor assessment coverage and remediation timeliness, highlight progress in reducing supply chain exposure, often a greater risk than internal systems.

Presented this way, metrics evolve from technical reporting into strategic insight, enabling boards to evaluate cybersecurity as a disciplined investment in business resilience.

Metrics to Avoid or Reframe for Non-Technical Audiences

While numerous metrics prove essential for security operations, they can diminish board confidence by emphasizing activity rather than business impact. Several common presentations require careful reconsideration before board delivery.

Raw Alert Volumes or Security Event Statistics

These create counterproductive impressions that suggest inefficiency rather than protection. Security leaders should instead report alert triage percentages meeting service level objectives or demonstrate false positive reduction trends that prove operational improvement.

Patch Management Statistics Without Business Context

These invite uncomfortable questioning about resource allocation priorities. Rather than presenting raw numbers, connect patching initiatives to outcomes by showing critical vulnerability remediation rates for revenue-generating systems meeting established timelines.

Technical Vulnerability Discoveries

These emphasize problems rather than progress, creating unnecessary anxiety about organizational exposure. Convert findings into risk terminology, such as financial exposure eliminated through high-impact vulnerability remediation, making progress tangible and reassuring.

Overwhelming Presentations With Raw Data

These consistently backfire by creating information overload and decision paralysis. Fear-based tactics create board fatigue and derail productive funding discussions. When directors encounter excessive jargon or inflated figures, attention shifts from strategic discussion toward cost center perception.

In essence, effective reframing is about linking technical metrics to business outcomes. Turning patch data into reduced downtime risk or showing alert volumes as faster response times shifts focus from fear to actionable insight.

How to Tailor Your ROI Story to Your Company's Priorities

Board engagement maximizes when cybersecurity metrics directly align with enterprise risk categories boards already monitor and fund. Transforming security from a cost center into quantified risk management requires aligning every data point with established business priorities.

Most boards monitor financial, operational, and compliance risk through established frameworks. That’s what you need to position the security metrics within these existing categories rather than presenting isolated cybersecurity dashboards. Directors respond most effectively when figures connect directly to revenue protection, operational continuity, or regulatory exposure.

Mapping Metrics to Enterprise Risk Objectives

Translate cybersecurity risks into corporate risk register terminology using established quantification methodologies to express threats in financial terms. Align each risk with the strategic initiatives board fund:

Digital transformation programs requiring secure cloud migration

Revenue-critical services demanding operational availability

Merger and acquisition activities requiring secure data access

Market expansion initiatives where compliance failures prevent growth

Present Annualized Loss Expectancy before and after control implementation, then calculate Return on Security Investment, demonstrating saved dollars per invested dollar. This approach mirrors board evaluation methodologies for other capital projects.

Customizing for Context and Benchmarking

There is no universal set of security metrics, and budget limits demand sector-specific focus. Global retailers emphasize third-party risk ratings, while financial institutions prioritize fast incident detection and response. Performance thresholds should match organizational maturity: newer organizations track security awareness, while mature enterprises measure recovery times against strict targets.

Benchmarking against industry peers with established assessment tools validates performance and provides boards with the evidence they need to support funding decisions.

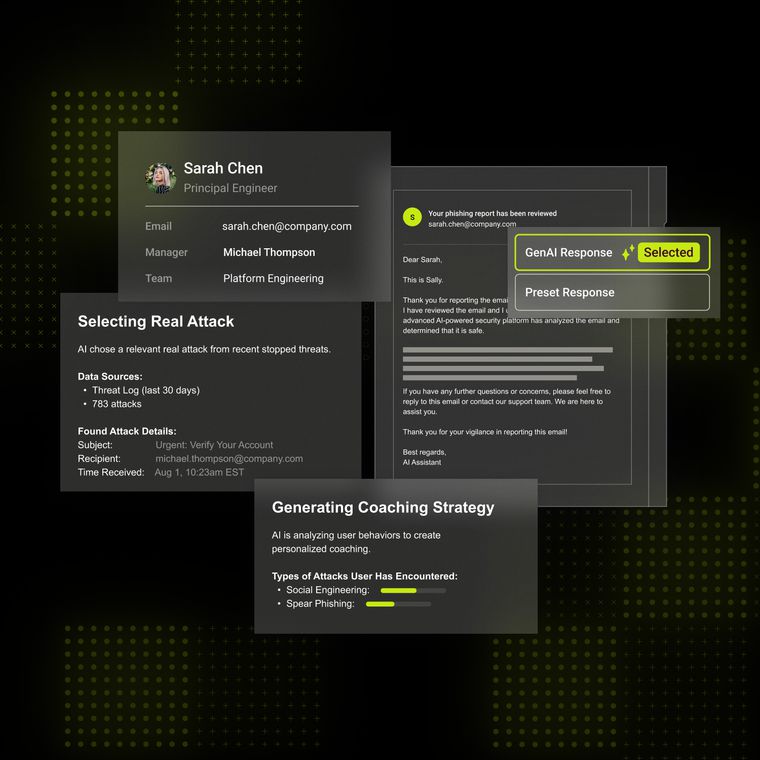

Turning Data into Influence with AI-Powered Insight

Communicating cybersecurity ROI effectively requires technology that converts raw data into business intelligence that boards can act on. AI platforms analyze communication behaviors, detect anomalies, and identify subtle compromise indicators before they disrupt operations. This advanced detection goes beyond traditional tools, creating a reliable baseline that uncovers threats early and protects business continuity.

AI-driven insights directly improve board-critical metrics such as Mean Time to Detect and Mean Time to Respond, providing measurable proof of operational effectiveness. They also deliver quantifiable risk reduction data, translating security investments into financial and operational value.

To engage boards, security leaders must present metrics tied to financial impact, operational resilience, and continuous improvement rather than activity counts. Abnormal’s AI-driven email security platform delivers the advanced detection and behavioral analysis required to demonstrate ROI and secure board confidence.

Book a demo to see how Abnormal turns security data into board-ready intelligence.

Related Posts

Get the Latest Email Security Insights

Subscribe to our newsletter to receive updates on the latest attacks and new trends in the email threat landscape.