Cost-Effective Strategies for Threat Detection in Insurance

Learn strategies for cost-effective threat detection in insurance to ensure compliance and protect against evolving cyber risks.

September 12, 2025

Insurance companies face escalating cyberattacks as sophisticated threat actors target the sector's valuable data repositories. Breaches at Aflac, Erie Insurance, and Philadelphia Insurance Companies reveal coordinated campaigns by groups like Scattered Spider, who use social engineering tactics to infiltrate networks and steal policyholder information including Social Security numbers, health records, and claims data.

The financial and regulatory impact compounds quickly. For instance, Erie Insurance already faces class-action litigation alleging inadequate cybersecurity measures, highlighting the legal exposure beyond direct breach costs.

Why Cybercriminals Target Insurance

Insurance companies store exactly what criminals want: complete identity profiles spanning decades. Each policyholder record contains Social Security numbers, medical histories, financial statements, and claims data that enable identity theft, financial fraud, and targeted social engineering. This concentrated data commands premium prices on criminal markets.

Breaches create immediate chaos. Customer trust evaporates, regulators launch investigations, and operations freeze while teams assess damage. The liability extends beyond direct costs as policyholders sue for inadequate data protection and partners terminate relationships. Insurance companies also maintain historical records across multiple systems and backup repositories, expanding the attack surface that criminals exploit through ransomware and data theft campaigns.

Why Threat Detection Matters in Insurance

Insurance companies face three critical vulnerabilities that attract sophisticated attackers.

First, regulatory complexity creates response delays. The National Association of Insurance Commissioners (NAIC) Model Law requires 72-hour breach notification across multiple states while GLBA mandates continuous monitoring. These competing requirements slow incident response when speed matters most.

Second, third-party ecosystems multiply risk. Every connection to reinsurers, agents, claims processors, and technology vendors creates potential attack vectors. Regulators treat third-party breaches identically to direct incidents, expanding liability beyond company control.

Third, insider threats exploit legitimate access. Employees need sensitive data for daily operations, making behavioral monitoring essential. Traditional perimeter security cannot detect authorized users stealing data or falling for social engineering schemes.

Why Traditional Defenses Fall Short

Conventional security tools cannot handle insurance-specific challenges. For instance, high transaction volumes through multiple channels generate constant false alarms that bury real threats. When systems flag thousands of legitimate claims as suspicious, analysts miss actual attacks. Signature-based detection only recognizes known threats, leaving companies blind to zero-day exploits and novel attack methods.

While various compliance standards in the industry requires proactive threat awareness, the traditional tools react only after attacks succeed. Insurance companies need threat detection designed for their reality: massive data flows, complex regulations, and extensive third-party connections that create unique vulnerabilities requiring specialized protection.

That said, here are five cost-effective strategies that enable insurance companies to detect threats efficiently while maintaining regulatory compliance and protecting customer assets.

1. Implement AI-Driven Security Automation

AI-driven security automation transforms how insurance companies detect and respond to threats. The technology learns normal behavior patterns specific to insurance operations, then automatically responds when something unusual happens.

Consider claims processing: AI systems monitor how adjusters typically work, then flag when someone accesses policyholder records outside their assigned territory or downloads unusual volumes of data. The system automatically quarantines suspicious sessions while alerting security teams with specific context about what triggered the response.

This immediate action prevents data theft while security teams investigate, protecting customer information without disrupting legitimate operations.

2. Deploy Managed Detection and Response Services

Managed Detection and Response (MDR) services provide expert threat hunting without expanding internal teams. These services specialize in identifying subtle attack indicators that automated tools miss.

MDR teams recognize credential stuffing patterns against policyholder portals before breaches succeed. They correlate failed login attempts across regions, spot reinsurance partner impersonation attempts, and implement protective measures immediately. This expertise proves especially valuable for insurance companies facing sophisticated attacks from organized crime groups who understand industry workflows and exploit trusted communication channels.

3. Establish Comprehensive Employee Cybersecurity Training

Employee training prevents breaches at their source: human error. Insurance-specific training programs simulate real attacks employees face daily, including fake regulatory audit notifications and fraudulent claims documentation requests.

These simulations teach staff to recognize phishing attempts that exploit insurance terminology and workflows. Employees learn why criminals target them specifically and how seemingly innocent requests compromise entire databases. Regular training transforms employees from vulnerabilities into defenders who spot and report suspicious activity before damage occurs.

4. Integrate Threat Intelligence Platforms

Threat intelligence platforms provide advance warning about attacks targeting insurance companies specifically. These platforms identify new ransomware variants attacking claims systems and fraud rings focusing on particular policy types.

Armed with this intelligence, security teams implement protective measures before threats reach their environment. The platforms share indicators about compromised vendor accounts, suspicious IP addresses targeting insurance portals, and emerging social engineering tactics. This proactive approach stops attacks during planning stages rather than after successful infiltration.

5. Adopt Regulatory-Aligned Cybersecurity Frameworks

Implementing frameworks like NIST provides structured security that satisfies regulatory requirements while optimizing investments. These frameworks translate complex regulations into actionable controls that insurance companies can implement systematically.

Framework adoption streamlines compliance through standardized controls and measurement criteria. The structured approach eliminates guesswork about regulatory expectations while building security that scales with business growth.

How Abnormal Supports the Insurance Industry

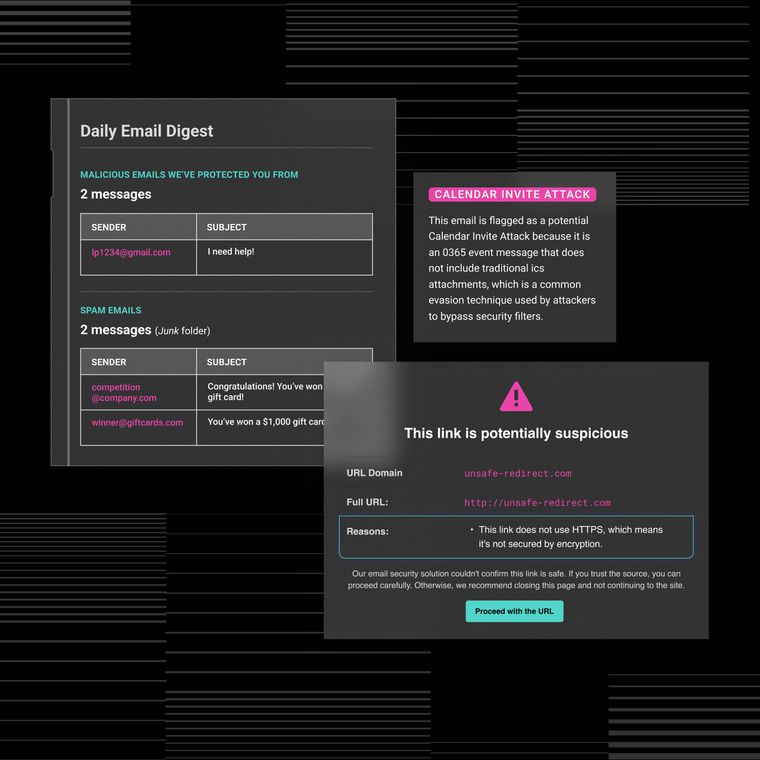

Abnormal's behavioral AI solves security challenges unique to insurance environments by learning how employees normally communicate and collaborate. The technology detects business email compromise and account takeover attacks that bypass traditional gateways by understanding the context behind every interaction. Through API-based integration with Microsoft 365 and Google Workspace, deployment takes minutes rather than months.

A Fortune 200 insurance and asset management leader protecting thousands of mailboxes demonstrates the impact. Despite existing security layers, the company suffered repeated credential phishing attacks and account takeovers that even bypassed multi-factor authentication.

After implementing Abnormal, the company:

Gained immediate visibility into the types of attacks, key recipients, attacker strategy, and attacker origin

Stopped over 3,500 credential phishing attacks and 190 unique business email compromise campaigns within the last 90 days

Implemented within 15 minutes and found one compromised account within the first day

The Vice President of Cyber Security captured the business impact: "High efficacy is important to us. We need to protect our employees and clients from all angles. We had multiple layers of email security, but it wasn't enough. We needed Abnormal to catch what others missed."

Ready to protect your insurance operations from advanced email threats? Explore our customer stories or get a demo to see how Abnormal can enhance your threat detection capabilities while supporting regulatory compliance.

Related Posts

Get the Latest Email Security Insights

Subscribe to our newsletter to receive updates on the latest attacks and new trends in the email threat landscape.