Email Security for Financial Services: 7 Ways to Use AI to Protect Your Business

See how AI email security for financial services safeguards data and meets regulations.

August 15, 2025

In May 2024, Evolve Bank & Trust, an Arkansas-based financial institution, suffered a ransomware attack linked to the LockBit threat group. The breach began when an employee clicked a malicious link, enabling attackers to infiltrate internal systems and steal sensitive data from approximately 7.6 million individuals. After Evolve refused to pay the ransom, the stolen data was published online.

This attack reflects a growing trend: cybercriminals are increasingly targeting financial institutions for their high-value data and direct access to funds. Email-based attacks in the finance sector rose 25% year over year, while business email compromise caused nearly $3 billion in losses in 2023 alone. With the average breach costing $5.97 million, email security is a critical business priority.

That said, this article outlines seven AI-driven strategies that’ll help you defend against evolving cyber threats.

Why Email Security Matters in Financial Services

Financial institutions are prime targets for email attacks that go straight after customer funds, sensitive data, and core operations. A single business email compromise can lead to million-dollar wire transfer fraud, leaked client information, and shut down trading systems.

When attackers compromise key email accounts, they can stop daily wire transfers, delay securities transactions, and lock customers out of their accounts. This hits revenue directly and shakes market confidence. Since most financial workflows run through email, one compromised account opens the door to everything.

The regulatory fallout comes fast. Data breaches mean tight reporting deadlines, hefty GDPR fines, and extra oversight from regulators. But the real damage is to reputation. When clients see their bank got hacked, they lose trust and move their money elsewhere. That gives competitors a lasting edge in an industry built on credibility.

What Makes Financial Services a Target

Financial institutions face concentrated email threats because they control immediate access to funds, store high-value data, and operate under time pressure that attackers systematically exploit.

Direct Monetization Opportunities

Threat actors target direct monetization opportunities through credential phishing and sophisticated impersonation attacks. A single well-timed email can redirect wire transfers or approve fraudulent payments within minutes of cutoff times.

Phishing topped cybercrime reports in 2024 with 193,407 complaints. Despite fewer incidents, financial losses jumped to $70 million, nearly quadrupling from the previous year. Since most successful cyberattacks begin with phishing, financial institution mailboxes become prime targets due to their payment templates, beneficiary instructions, and trading algorithms.

High-Value Data Repositories

Email systems contain data that criminals monetize immediately. Customer PII, account credentials, trading algorithms, and M&A intelligence frequently travel through standard business communications. Financial institutions routinely exchange payment templates, beneficiary instructions, proprietary algorithms, market-moving research, KYC documents, statements, tax forms, board minutes, audit reports, and stress-test results. This concentrated wealth of sensitive information makes email the most attractive entry point for cybercriminals targeting financial services.

Operational Deadline Pressure

Settlement windows, FX cutoffs, and end-of-day funding naturally create time pressure that social engineering attacks exploit effectively. When a spoofed CFO emails at 4:47 p.m. requesting urgent beneficiary updates before market close, the timing perfectly aligns with normal business operations. Staff focus on meeting critical deadlines rather than verification protocols, making these precisely-timed attacks particularly effective.

Hierarchical Vulnerability Structures

Clear reporting chains mean staff rarely question executive directives. Attackers hijack email threads or spoof domains that pass authentication protocols, inserting payload-free messages that bypass traditional gateways and reach approval workflows directly. This account takeover risk increases with organizational complexity.

Extended Partner Networks

Each vendor relationship creates potential entry points where compromised suppliers can insert fraudulent invoices into ongoing conversations. Partner domains appear trustworthy, making bank detail changes seem routine until funds disappear. Vendor email compromise affects financial institutions disproportionately due to their extensive third-party ecosystems.

Why Traditional Defenses Fall Short

Legacy secure email gateways depend on static indicators, yet modern attacks in financial services hinge on human trust and business context that these tools never analyze.

Missing Intent-Based Fraud

Content filters flag known-bad links and malware, but business email compromise often arrives clean with no payload, only a request to change a vendor's bank account or expedite a wire. Because the email passes SPF, DKIM, and reputation checks, the gateway delivers it. That said, email-based fraud accounts for financial-fraud losses even in firms running layered filtering stacks.

Treasury teams routinely exchange last-minute payment instructions, so urgency alone never raises a rule-based alarm. Without behavioral baselines for amounts, approval chains, and counterparties, traditional controls cannot distinguish routine business from six-figure fraud.

Struggling With PhaaS Evasion

Phishing-as-a-Service kits now serve bank-branded templates, real-time reCAPTCHA, and adversary-in-the-middle logic that steals session cookies to bypass multifactor authentication. These campaigns also embed QR codes that victims scan on mobile devices, sidestepping gateway URL rewriting.

Without device context or cross-channel correlation, legacy tools misclassify these low-signal attacks as benign, leaving account takeover and downstream fraud undetected. Modern AI-enabled cyberattacks require equally sophisticated defensive capabilities.

Overlooking Operational Blind Spots

Banks depend on sprawling ecosystems of custodians, fund administrators, and fintech vendors. A single compromised supplier can inject fraudulent invoices that look entirely legitimate. Rule-based defenses lack the behavioral context to spot a supplier suddenly emailing from an unfamiliar IP range or requesting unusual banking details.

Also, remember that endpoint products detect threats only after delivery, forcing employees to act as the last line of defense, which is an approach that fails under the pressure of quarter-end cutoffs. Compliance controls such as encryption and DLP satisfy auditors, yet they do nothing to validate payment intent, creating dangerous security gaps.

7 Ways to Use AI to Protect Your Financial Services Business

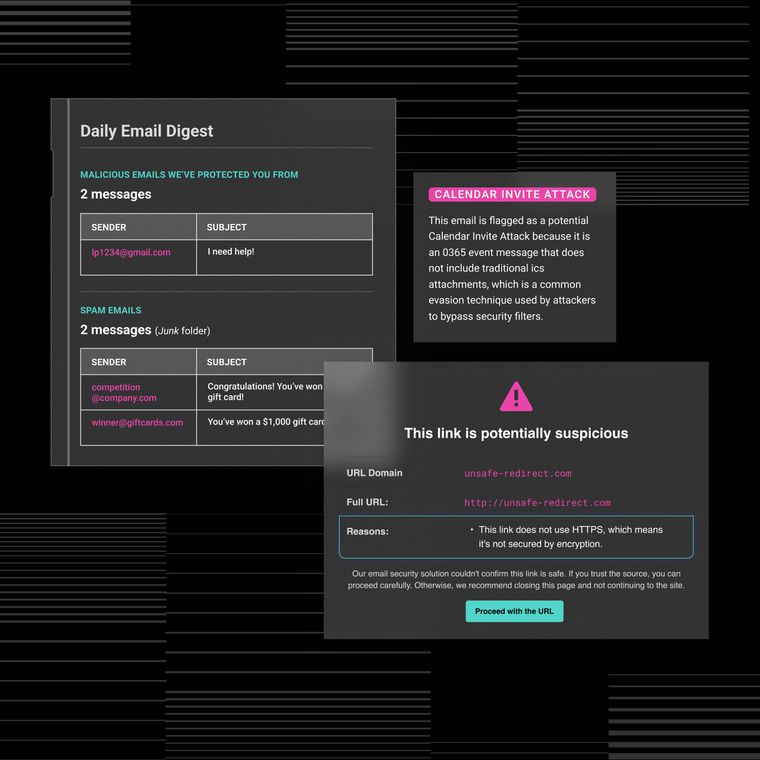

AI-driven email security excels at spotting what legacy filters miss: the subtle behavioral shifts that precede wire fraud, data exfiltration, and account takeover. By learning how your people, partners, and clients normally communicate, modern models surface anomalies in milliseconds—then act before funds move or data leaves the building.

1. Deploy Behavioral Anomaly Detection Across Identity, Content, and Context

Behavioral AI builds living baselines for every mailbox, vendor, and workflow, tracking who emails whom, when, and about what. When an off-hours message arrives from a client relationship manager instructing a large transfer to an unrecognized account, the system flags the deviation and holds the email before anyone processes the request.

The model correlates identity signals (new device or IP), content cues (payment language), and relational context (never requested funds before) to detect fraud that passes SPF, DKIM, and SEG checks.

2. Implement AI-Native BEC and Vendor Fraud Prevention

Machine learning models map executive habits, supplier invoicing cycles, and historical payment metadata to flag unexpected bank-detail changes from trusted vendors. This approach stops the silent, no-malware fraud that slips past traditional gateways.

AI scores requests against peer transactions, surfaces risk levels, and routes emails for out-of-band verification, preventing six- and seven-figure losses without slowing legitimate payouts. Detection operates independently of links or payloads, blocking sophisticated impersonation attacks that fool well-tuned rules engines.

3. Counter Generative AI-Powered Impersonation Attacks

Attackers now use large language models to mimic tone, punctuation, and emoji patterns, making AI-written phishing increasingly sophisticated. Defense must pivot from content analysis to sender-recipient relationships and historical thread behavior.

Behavior-first models flag sudden funding requests, even when they perfectly match an executive's writing style, by focusing on relational anomalies. These polymorphic lures evolve faster than rule updates, but continuous learning neutralizes them by treating any behavioral deviation as suspicious, not just unusual text strings. Natural language processing capabilities enhance this detection accuracy.

4. Establish End-to-End Protection Across All Communication Channels

Banks exchange passports, tax forms, and payment instructions over email continuously. AI monitors the same conversational graph in all directions, allowing clients to send KYC documentation inbound while blocking compromised insiders who suddenly forward hundreds of passports outbound.

The platform automatically quarantines, strips attachments, or throttles delivery based on confidence levels. Continuous learning across internal traffic exposes lateral attacks that legacy tools ignore, cutting dwell time from days to minutes through automated email remediation.

5. Deploy Payment and Finance Workflow Safeguards With Contextual Intelligence

Treasury operations depend on predictable approval chains and cut-off times. AI models those patterns such as recurring vendors, average amounts, dual-signatory requirements, and intervenes when something drifts. The first-time requests to update SWIFT codes for long-standing counterparties trigger automatic holds, while approvers receive contextual banners explaining the anomaly.

These safeguards help prevent potential account-takeover losses by blocking fraudulent fund transfers before settlement, delivering tighter payment security without adding friction to end-of-day liquidity sweeps or urgent client disbursements. Risk-based authentication enhances this protective framework.

6. Implement Supply Chain and Partner Risk Modeling

Email risk extends to every law firm, fund administrator, and fintech API in your ecosystem. AI learns normal partner domains, cryptographic posture, and communication cadence, then flags the smallest shifts, newly registered look-alike domains or compromised vendors emailing outside business hours.

Since vendor compromise seeds multi-company fraud, modeling supply-chain behavior protects as critically as executive mailboxes. When the system identifies sudden increases in invoice-attachment size or domains failing DMARC after years of compliance, it auto-quarantines threads and alerts procurement leads to validate authenticity.

7. Enable Automated, Closed-Loop Response for Rapid Containment

Detection without speed fails to stop fraud. AI triages alerts, retroactively retracts delivered threats, and disables malicious links across affected inboxes, shrinking response windows to seconds.

Also, high-confidence attacks are purged without human review, while medium-confidence cases arrive pre-correlated for strategic analysis. With attack volume against institutions up year over year, closed-loop response provides the only scalable defense without expanding headcount.

How Abnormal Supports Financial Services Teams

Abnormal delivers AI-driven email security built for the high-stakes demands of financial services. For instance, credential phishing was responsible for 80% of advanced email attacks in 2024. Such attacks often target executives, payroll teams, and finance staff. Abnormal detects suspicious language, tone, and style, even without links or attachments, stopping phishing before it reaches inboxes.

Supply chain compromise is another critical risk, with organizations facing a 25% weekly chance of attack. Abnormal’s VendorBase™ identifies and continuously monitors vendors, assigning risk scores to block fraudulent payment requests from compromised accounts. For account takeover attempts, Abnormal analyzes behavior, login patterns, and identity signals to auto-remediate compromised accounts.

Securing Investment Banking Operations with AI-Powered Email Defense

Greenhill & Co., a global investment banking firm managing multibillion-dollar deals across 600+ mailboxes, faced sophisticated BEC attacks targeting sensitive M&A communications. Legacy security tools missed executive impersonation and vendor compromise attempts, threatening client confidentiality and regulatory compliance.

Abnormal's behavioral AI transformed their email security posture. The platform's API-based deployment took just minutes with zero mail flow disruption, invisibly monitoring communications to baseline normal behavior patterns.

Once enabled, Abnormal's intelligence engine delivered comprehensive protection:

130+ BEC attacks blocked, including CEO impersonation and fraudulent invoice redirections

70+ compromised vendor accounts automatically identified through VendorBase intelligence

7,000+ credential phishing attempts stopped before reaching employee inboxes

Seamless accuracy with virtually no false positives requiring manual email releases

The solution also streamlined incident response, with planned SOAR integration enabling automated account takeover workflows. "Abnormal works invisibly behind the scenes, freeing our team to focus on strategic security initiatives," said CIO/CISO John Shaffer. "We now have complete confidence against sophisticated email threats targeting our high-value transactions."

Request a demo to see Abnormal in action, or explore our customer stories for real-world results from leading financial institutions.

Related Posts

Get the Latest Email Security Insights

Subscribe to our newsletter to receive updates on the latest attacks and new trends in the email threat landscape.